Financial Planning Before & After a Divorce: A Guide for Women Navigating Life’s Transition

Divorce is one of life’s most emotionally charged and financially complex transitions. Whether you are just beginning to consider it, actively going through the process, or finding your footing after it’s finalized, your financial life will inevitably change. For many women—whether a successful professional or a full-time caregiver to children—this can feel overwhelming, isolating, and uncertain.

At Gatewood Wealth Solutions, we recognize that divorce is not just a financial event—it’s an emotional journey filled with grief, fear, uncertainty, and sometimes betrayal. It affects more than just the couple—it ripples into relationships with children, in-laws, mutual friends, and shared professionals who may now be forced to choose sides.

Trust can be deeply shaken. That’s why our approach is grounded in empathy, discretion, and partnership. We walk with our clients through every stage—supporting them not just as financial advisors, but as steady, compassionate allies in a time of profound change.

This guide outlines the key considerations you need to think through—and the actions you should take—as you navigate this pivotal chapter.

When You’re Considering a Divorce

Before any paperwork is filed, it’s essential to take stock of your situation:

- Understand your financial position: Begin gathering all relevant documents—tax returns, bank and investment statements, insurance policies, loan documents, retirement accounts, and household expenses.

- Assess your lifestyle and spending: What does it cost to live your current life? What expenses may remain or change post-divorce?

- Consider future housing and income needs: Will you stay in the home? Will you need to re-enter the workforce?

- Meet with a financial advisor and attorney confidentially: Even if you aren’t sure you’ll move forward, early professional advice can help you understand your rights, risks, and options.

This stage is about preparation. Quietly gathering information and creating a plan helps protect your interests and gives you space to process what’s ahead emotionally.

Types of Divorces and Their Implications

Understanding the process can help you choose the right path:

- Mediated Divorce: A neutral third-party mediator helps spouses negotiate terms. Often lower in cost and less adversarial.

- Collaborative Divorce: Each spouse has their own attorney, but all commit to resolving without litigation. Additional experts, like financial advisors or therapists, may be involved.

- Litigated Divorce: If cooperation breaks down, the case proceeds to court. This is often the most contentious and expensive route.

The choice impacts your financial, emotional, and relational outcomes. Working with a financial advisor early can help you evaluate settlement options from a long-term planning lens and ensure you’re emotionally supported throughout the process.

Financial, Legal & Emotional Challenges for Women

Whether you’re a professional earning a significant income or a stay-at-home parent managing the household, divorce introduces several issues:

For Working Professionals:

- Dividing complex assets like equity compensation, business interests, and retirement plans

- Adjusting to new tax liabilities and loss of household income

- Protecting future earnings from excessive support obligations

For Stay-at-Home Mothers:

- Understanding entitlements to spousal or child support

- Re-entering the workforce or seeking training

- Securing long-term financial independence post-divorce

For All Women:

- Creating a new personal budget and financial plan

- Updating wills, trusts, beneficiary designations, and account titling

- Managing emotional trauma, decision fatigue, and shifts in family and social circles

- Navigating loss of shared friendships and community

We understand that many women feel lost in this transition. Trust in others—even professionals—can feel fragile. That’s why working with a firm like Gatewood, where we prioritize empathy, clarity, and transparency, can be a stabilizing force. Our goal is to rebuild your sense of control and confidence in your future.

A financial advisor can act as a steady hand through these transitions, helping ensure nothing falls through the cracks.

The Role of the Financial Advisor in a Divorce

A qualified financial advisor does more than analyze numbers—they provide clarity, structure, and emotional steadiness. They:

- Create financial models to evaluate settlement options

- Project cash flow and retirement viability post-divorce

- Inventory and organize assets and liabilities

- Assist in updating legal documents and insurance policies

- Coordinate with your attorney, CPA, and other relevant professional advisors

- Provide clarity when emotions are high and decisions feel overwhelming

At Gatewood, we are skilled at guiding clients through emotionally sensitive transitions with the care and confidentiality they deserve.

We build comprehensive plans tailored to your new life—empowering you to move forward with confidence.

What Documents Should You Have

- Tax returns (3 years)

- Bank, investment, and retirement account statements

- Pay stubs and income documentation

- Mortgage and debt documents

- Insurance policies (health, life, disability)

- Prenuptial or postnuptial agreements

- Estate planning documents

These help define marital vs. separate property and inform negotiation strategy. Having them prepared gives you a stronger voice in conversations that may feel emotionally loaded.

Evaluating Employee Benefits

Benefits can be an overlooked asset. Make sure to:

- Review health insurance options (COBRA, marketplace, employer coverage)

- Assess pensions, 401(k)’s, RSUs, or stock options

- Understand dependent care benefits or FSA’s

- Clarify ownership or division of group life insurance policies

If you’re covered under your spouse’s benefits, have a plan for transitioning off.

Practical Steps to Take During a Divorce

- Assemble a professional team: attorney, financial advisor, therapist

- Open individual bank and credit accounts

- Track your income and spending

- Freeze or monitor credit

- Establish a post-divorce budget

- Update passwords and secure personal information

- Review estate plan and insurance needs

We guide clients through each of these so they feel supported and informed—not alone.

Two Examples of Planning in Action

Case Study 1: Sarah, Corporate Executive

Sarah was a high-earning executive who handled investments but never paid much attention to cash flow. During her divorce, we:

- Modeled child support and alimony scenarios

- Analyzed division of deferred compensation and RSU’s

- Built a post-divorce financial plan that ensured she could maintain her lifestyle and retire on time

- Worked with her attorney to structure settlement payments in a tax-efficient way

Sarah walked away empowered, informed, and with a clear roadmap for her financial future.

Case Study 2: Emily, Stay-at-Home Mom

Emily had been out of the workforce for 15 years, raising her three children. We:

- Helped her inventory marital assets

- Coordinated with her attorney to secure support and long-term housing

- Built a cash flow plan with gradual return-to-work assumptions

- Worked with an estate attorney to update her will and establish a trust for the children

Emily gained financial confidence and clarity, with a plan that gave her options.

A Final Word and Where You Can Turn

Divorce doesn’t have to mean financial confusion or fear. With the right team and the right plan, you can take control of your future, protect what matters, and make empowered decisions.

At Gatewood Wealth Solutions, we specialize in helping women plan through and beyond divorce. Whether you’re just starting to consider it or have finalized it and need help rebuilding, we’re here for you.

Let’s talk. Your next chapter deserves a solid plan.

Important Disclosures

This material was created for educational and informational purposes only and is not intended as tax, legal or investment advice. For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither LPL Financial nor any of its representatives may give legal or tax advice.

This is a hypothetical situation based on real life examples. Names and circumstances have been changed. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments or strategies may be appropriate for you, consult your advisor prior to investing.

Major Tax Bill Clears the House {Updated 07/09/2025}

[Updated as of 07/09/2025]

On July 7, 2025, the “One Big Beautiful Bill,” a major tax and spending package we’ve been closely tracking, was officially signed into law by the President. We’ve broken down the new changes to help you easily understand how this might affect you, your family, and your financial plans.

What’s in the Final Law?

Permanent Lower Taxes for Individuals

Good news! Lower tax rates and the bigger standard deduction that came from the 2017 tax law (often called the TCJA) are now permanent. This means most people will continue paying less in taxes long-term.

Increased SALT Deduction Cap

If you live in a state with higher taxes, you’ll appreciate this one: The deduction limit for state and local taxes (SALT) has increased from $10,000 to $40,000. However, this benefit phases out if your income is above $500,000.

Special Deductions for Workers and Seniors

- No Federal Tax on Tips and Overtime: Workers who rely on tips or overtime pay won’t pay federal taxes on these earnings between 2025 and 2028, as long as income stays under certain limits ($150K individual/$300K family).

- Extra Deduction for Seniors: If you’re 65 or older, you’ll get an extra deduction ($6,000 if single, $12,000 if married), helping reduce or eliminate taxes on Social Security and other income. This deduction phases out at higher income levels.

Estate Tax Exemption Increase

The exemption for estate taxes is now permanently set at $15 million per person, helping families pass more of their wealth to their heirs without tax penalties.

Good News for Business Owners

- Bonus Depreciation: If you’re investing in your business, you’ll be able to write off 100% of qualifying expenses immediately (from 2025–2029).

- Section 179: Small business owners can now immediately expense up to $2.5 million of equipment, helping with cash flow.

- Research and Development: If your business invests in research, new rules let you write off these expenses more easily through 2029.

- QBI Deduction: The 20% deduction for pass-through business income is now permanent, and it phases out gradually for high earners, rather than disappearing all at once.

Energy and Community Investments

- Clean-energy tax credits are being reduced, but you can still access some incentives for solar and electric vehicles under stricter rules.

- Opportunity Zone investments continue, especially encouraging investment in rural and underserved communities.

Families and Children Benefit Too

- A new “Trump Savings Account” allows families to contribute up to $1,000 per year per child born after 2024, offering tax-friendly growth potential.

- Child tax credits have increased, providing additional support for families.

Social Program Changes

- There are new, stricter work requirements for Medicaid and SNAP (food stamps). While this is intended to encourage employment, it may affect some families negatively.

What Did NOT Pass?

- The corporate tax rate stays at 21%. It was not reduced to 15% as previously proposed.

- The estate tax was not eliminated, just increased significantly.

- Taxes on Social Security benefits were not completely removed, although many seniors will effectively see little to no tax on their benefits due to the senior deduction.

Who Benefits, and Who Might Face Challenges?

Winners:

- Middle-income households due to lower taxes and increased deductions.

- Small and medium-sized business owners with more tax incentives.

- Families who can use the higher estate exemptions.

- Seniors benefiting from additional deductions.

- Families with young children through new savings opportunities.

Those Facing Challenges:

- Higher earners in high-tax states due to limited SALT benefits.

- Consumers and businesses involved in renewable energy due to fewer incentives.

- Lower-income households impacted by stricter Medicaid and SNAP requirements.

We understand that these changes might have mixed impacts depending on your situation. Our priority is making sure you have a clear, easy-to-follow plan.

How Gatewood Wealth Solutions is Here for You

We’re already working to help our clients:

- Understand exactly how these changes impact your unique situation.

- Adjust your strategies to make the most of new opportunities.

- Seek to ensure you’re well-prepared and protected from unintended consequences.

As always, please reach out to us if you have questions or would like personalized advice on navigating these new changes. We’re here to guide you every step of the way.

[Original Article from 06/03/2025]

On May 22, 2025, the U.S. House of Representatives narrowly passed a nearly $4 trillion tax bill known as the “One Big Beautiful Bill” by a 215-214 vote. The legislation includes the most significant tax changes proposed since 2017, including permanent extensions of key provisions from the Tax Cuts and Jobs Act (TCJA), new deductions, and revised rules for both individuals and businesses.

While this is a major step, it is not yet law. The bill now heads to the Senate, where changes are likely. The administration has signaled an interest in seeing legislation finalized by July 4, though many expect the timeline may extend into August or beyond, depending on the pace of negotiations.

Here’s what you need to know — and what we’re doing to help you prepare.

Key Highlights from the House Bill

For Individuals:

- Permanent extension of TCJA provisions, including lower individual tax rates, an expanded standard deduction, and repeal of personal exemptions.

- Increased child tax credit to $2,500 per child for tax years 2025 through 2028.

- Higher SALT deduction cap, raising the limit from $10,000 to $40,000 for households earning under $500,000, with the cap and income threshold indexed by 1% annually through 2033.

- New above-the-line deductions for seniors ($4,000), tip income, overtime pay, and up to $10,000 in U.S. auto loan interest—each subject to income limits.

Estate Planning Updates:

- Increased lifetime exemption for estate, gift, and generation-skipping transfer taxes to $15 million starting in 2026, indexed for inflation. This builds on the existing TCJA levels, which reach nearly $14 million in 2025.

For Business Owners:

- Bonus depreciation restored at 100% for qualifying assets placed in service between 2025 and 2029.

- Section 179 expensing limits increased to $2.5 million, with a $4 million phaseout threshold.

- Domestic R&D expensing reinstated for 2025 through 2029 under a new Section 174A structure.

- Section 199A (Qualified Business Income Deduction):

- Deduction rate increased from 20% to 23% starting in 2026.

- Phaseout reform: For service businesses, it expands eligibility and the deduction phases out gradually—reducing by 75 cents for each dollar of income over the threshold—making planning more predictable and makes the deduction permanent. (I removed the comma in this sentence.)

- Expanded eligibility: Certain dividends from Business Development Companies now qualify for the deduction.

- Permanence: The deduction is made permanent, ending its previous 2025 sunset.

Other Notables:

- Energy credit repeals and phaseouts: The legislation rolls back tax credits from the Inflation Reduction Act, affecting wind, solar, and battery storage projects, and potentially increasing household energy costs.

- Opportunity Zone extension through 2028, with new incentives for rural investment.

- International and reciprocal taxes, including changes to GILTI, FDII, BEAT, and new retaliatory taxes for countries imposing “unfair” taxes on U.S. firms.

- Medicaid & SNAP Changes: The bill imposes stricter work requirements for Medicaid and the Supplemental Nutrition Assistance Program (SNAP), potentially affecting millions of low-income Americans.

- Introduction of “Trump Savings Accounts”: The bill creates $1,000 “Trump savings accounts” for children born after 2024, offering tax-deferred savings with capital gains tax rates on withdrawals.

- Student Loan Forgiveness Repeal: The legislation repeals student loan forgiveness options under President Biden’s SAVE plan and introduces new repayment plans.

- Defense & Border Security Funding: The bill allocates $150 billion to defense spending and $70 billion to border security, including funding for mass deportations and border infrastructure.

What Happens Next?

The Senate is expected to take up the bill in June, possibly bypassing committee review in favor of direct negotiations. Any significant changes made by the Senate would require another vote in the House before the bill can be enacted. While many core elements of the bill enjoy broad Republican support, there are competing priorities among Senate members — particularly around energy credits, international taxation, and the scope of permanent provisions.

How Gatewood Is Preparing Our Clients

With major tax changes on the horizon and year-end planning season approaching, timing and strategy will be critical. At Gatewood Wealth Solutions, we’re preparing our clients for all possible outcomes — and we’re starting now.

Here’s how we’re helping:

- Running personalized tax scenarios under both current law and the proposed changes, so you can make informed decisions now — not after the fact.

- Identifying strategic opportunities to leverage new deductions, avoid phaseouts, and optimize entity structures and income timing.

- Reviewing estate and business plans to take advantage of proposed changes, including the increased estate exemption and favorable treatment of business investments and income.

You don’t need to wait for the final vote to start planning. Strategic action today can create lasting benefits regardless of how the final bill takes shape.

If you’re ready to review your plan or want to understand how this legislation could impact your financial goals, let’s talk. We’re here to guide you through it — with clarity, strategy, and purpose.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for individualized tax advice. We suggest that you discuss your specific tax situation with a qualified tax advisor.

Money Considerations When Becoming a Caregiver for Aging Parents

As Americans live longer, more adult children are stepping into a new and emotionally complex role: caregiver for aging parents. While this caregiving journey is often rooted in love and duty, it comes with significant financial, legal, and emotional challenges—many of which families are unprepared to navigate.

At Gatewood Wealth Solutions, we help families prepare for life’s key moments. Becoming a caregiver is one of those moments, and having the right plan in place can help you support your parents without jeopardizing your own financial well-being or confidence.

The Situation Many Couples Face

The typical scenario starts subtly. One parent begins needing help with errands, then medications, then transportation. Eventually, the need grows to include daily support—bathing, dressing, managing bills—or even full-time care.

For couples in their 40s, 50s, or 60s, this can be a difficult balancing act. They may still be working full-time, saving for retirement, or even supporting children in college. When caregiving duties grow, it creates stress, financial strain, and difficult decisions:

- Should one spouse reduce hours or leave work entirely?

- How do we pay for in-home care or assisted living?

- Are we prepared for the legal and medical decisions ahead?

- Will this derail our own retirement?

These are deeply personal—and deeply financial—questions.

Financial Considerations for Caregiving

Caring for a parent can quickly become a financial responsibility. Common costs include:

- Home modifications (ramps, walk-in tubs)

- In-home caregivers or visiting nurses

- Adult daycare programs or respite care

- Transportation services

- Medications, co-pays, or specialized therapies

- Long-term care or assisted living facilities

Medicare Vs. Medicaid: What They Cover (and what they don’t)

Medicare is health insurance primarily for those 65 and older. It covers hospital care, doctor visits, and short-term rehabilitation—but NOT long-term custodial care such as help with bathing, dressing, or eating.

Medicaid, on the other hand, is a needs-based program that can cover long-term care in a facility or at home—but only for individuals with very limited income and assets.

Coordination Between the Two:

In some cases, individuals can qualify for both Medicare and Medicaid (known as “dual eligibility”), but coordinating these benefits is complex and often requires professional guidance. Timing, asset structuring, and proper documentation are key to avoiding disqualification or delays in coverage.

Legal and Estate Planning Issues to Address

When you step into a caregiving role, you also step into a world of legal responsibilities. The following should be reviewed or created:

- Powers of Attorney (Financial & Medical): Ensure someone has legal authority to act on your parent’s behalf.

- Living Will/Advance Directive: Clarifies wishes regarding life-sustaining treatment.

- HIPAA Authorizations: Grants access to medical records.

- Updated Wills and Trusts: Review beneficiary designations, successor trustees, and asset titling.

- Asset Protection Planning: If long-term care may be needed, there are legal strategies to protect family assets within Medicaid’s lookback rules.

Gatewood can work alongside estate attorneys to help ensure the proper legal structures are in place and coordinate with elder law specialists when necessary.

Emotional and Lifestyle Strain

Many caregivers experience:

- Guilt over not doing enough

- Burnout from juggling work, children, and caregiving

- Conflict with siblings or spouses over roles and responsibilities

- Grief as they watch a parent’s health decline

We often remind families: you cannot pour from an empty cup. Planning ahead financially and legally can ease the stress and allow more energy for the emotional and relational aspects of caregiving.

Resources for Caregivers

You’re not alone in this journey. Here are a few reputable resources:

- Area Agencies on Aging (AAA): Local support and information services

n4a.org - Eldercare Locator: A free service to connect caregivers with local help

eldercare.acl.gov - Family Caregiver Alliance: Tools, education, and support groups

caregiver.org - Medicare.gov: Coverage information, providers, and cost estimators

www.medicare.gov - Medicaid Planning Resources: State-specific resources available through local elder law attorneys or planning professionals

How Gatewood Can Help

At Gatewood, we guide families through the complexities of caregiving—from financial planning to legal coordination to emotional support strategies. We:

- Model the impact of caregiving expenses on your own retirement plan

- Coordinate with estate attorneys and elder law professionals

- Identify insurance and long-term care funding options

- Help facilitate family conversations and clarify roles

- Help ensure planning stays aligned across generations

A Final Thought

You may never feel fully ready to become a caregiver—but with thoughtful preparation and the right support, you can approach it with confidence, clarity, and compassion.

If you’re facing—or anticipating—the responsibility of caring for an aging parent, let’s have a conversation. We’re here to help you prepare financially and emotionally for one of life’s most important roles.

Important Disclosures:

This material was created for educational and informational purposes only and is not intended as tax, legal or investment advice. For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither LPL Financial nor any of its representatives may give legal or tax advice.

Gatewood Glide: Asset Allocation by Wealth Stage

Investing isn’t one-size-fits-all. At Gatewood Wealth Solutions, we’ve built a tailored approach—The Gatewood Glide—designed to support investors through each stage of their financial journey, from early accumulation to meaningful legacy-building.

Phase 1: Cultivating – The Habit-Builder

Persona: Early-career professional (entry-level), often single, establishing money habits.

Primary Goals:

- Develop solid financial habits.

- Avoid debt; build credit responsibly.

- Start investing and saving consistently.

Recommended Allocation:

| Account Type | Allocation |

| 401(k) | 100% equities |

| Emergency Fund | 3–6 months (cash in hub account) |

| Bonds | 0% |

| Alternatives | 0% |

Planning Tips:

- Embrace volatility. You have decades to ride out market fluctuations.

- Prioritize aggressive growth potential (e.g., Total Market Index).

- No fixed income needed yet—keep it simple and growth-oriented.

Phase 2: Building – The Growth-Engine Household

Persona: Dual-income couples, high earners, on track to wealth accumulation.

Primary Goals:

- Maximize contributions to tax-advantaged retirement accounts.

- Fund goals: home purchase, family, education.

- Explore early wealth transfer or entrepreneurial opportunities.

Recommended Allocation:

| Account Type | Allocation |

| 401(k) | 100% equities (maximize contributions) |

| Emergency Fund | 6 months (dual-income) or 12 months (single-income) |

| Bonds | 0% |

| Alternatives | 0% |

Planning Tips:

- Continue aggressive accumulation—bonds aren’t beneficial yet.

- Use Roth conversions and prioritize tax advantages.

- Maintain liquidity for near-term goals without sacrificing growth.

Phase 3: Activating – The Glide Begins (10 Years Pre-Retirement)

Persona: Peak-earning years, retirement horizon in sight.

Primary Goals:

- Gradually reduce risk exposure without sacrificing growth.

- Establish liquidity buffers.

- Maintain purchasing power.

Recommended Allocation:

| Account Type | Baseline Allocation | Range |

| Equities | 80% | 70–90% |

| Fixed Income | 20% | 10–30% |

| Alternatives | 0% (default), up to 10% | 0–10% |

| Cash | 12–24 months (gradually increase toward retirement) |

Planning Tips:

- Initiate the Gatewood Glide: gradually shifting equities from ~100% down to ~65% over ten years.

- Bonds and cash to cover initial 5–7 years of retirement spending.

- Consider alternatives based on eligibility and appetite for diversification.

- Align risk tolerance and financial goals clearly—differentiate from traditional target-date funds.

Phase 4: Enjoying – The Confident Retiree

Persona: Retired, financially independent individuals.

Primary Goals:

- Sustain spending comfortably.

- Mitigate sequence-of-returns risk.

- Minimize tax drag and financial anxiety.

Recommended Allocation:

| Account Type | Baseline Allocation | Range |

| Equities | 65% | 55–75% |

| Fixed Income | 30% | 20–40% |

| Alternatives | 5% (up to 15%) | 0–15% |

| Cash | 24 months of expenses (cash-flow strategy) |

Planning Tips:

- Equities seek to ensure long-term growth, seeking inflation protection.

- Bonds secure spending needs for 5–10 years, offering stability during downturns.

- Alts enhance diversification (private credit, real estate, private equity).

- Tail-risk scenarios (1970s stagflation, 2000s Dotcom) built into strategic planning.

Phase 5: Giving – The Legacy Builder

Persona: Ultra-high-net-worth retirees, philanthropically inclined.

Primary Goals:

- Create lasting legacies through strategic philanthropy.

- Optimize institutional-level investment efficiency.

- Maintain liquidity and simplicity in complex financial environments.

Recommended Allocation:

| Account Type | Allocation | Notes |

| Equities | ~65% | Potentially higher if longevity risk is minimal |

| Fixed Income | ~30% | 5–10 years of projected spending |

| Alternatives | 5–15% | Greater access to institutional strategies |

| Cash | 24+ months (flexible) | Dependent on philanthropic activities |

Planning Tips:

- Aggressively utilize alts if liquidity allows.

- Prioritize tax-efficient giving (Donor-Advised Funds, Charitable Remainder Trusts, foundations).

- Balance preservation, growth, and gifting efficiency carefully.

What Sets Gatewood Glide Apart?

The Gatewood Glidepath significantly diverges from traditional target-date funds. Here’s how:

- Aggressive early equity exposure: Starting nearly fully invested in stocks (98%) seeking to maximize growth early on.

- Higher equity at retirement: Maintains ~70% equity at retirement, significantly higher than the industry average (~50%), seeking to ensure ongoing portfolio growth potential.

- Long-term growth-oriented approach: Treating retirement not as the end of growth, but as the start of a new investment horizon.

Final Thoughts: Why Gatewood Glide Matters

At Gatewood Wealth Solutions, our Glidepath isn’t just about reaching retirement—it’s about confidently soaring through it. By prioritizing growth through higher equity allocations, our goal is to enable our clients not just to retire, but to retire well—maintaining their lifestyles, preserving their purchasing power, and pursuing meaningful legacies.

In short, the Gatewood Glide is designed not just for longevity, but for prosperity.

Because retirement shouldn’t mean slowing down; it should mean continuing your ascent.

Ready to Glide?

Connect with our team to start your personalized journey toward financial clarity and confidence.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

This information is not intended to be a substitute for individualized tax advice. We suggest that you discuss your specific tax situation with a qualified tax advisor.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise. Bonds are subject to availability, change in price, call features and credit risk

The principal value of a target fund is not guaranteed at any time, including at the target date.

Smart Cash Strategies for Today’s Investors

At Gatewood Wealth Solutions, we believe your cash should do more than just sit in a savings account. Whether you need short-term income or are planning for a future large expense, there are smart, managed strategies designed to keep your money working while staying aligned with your financial goals. That’s where our Cash Flow Advisory Strategy and Lump Sum Advisory Strategy come in.

What Are These Strategies?

Both strategies are actively managed cash and cash-equivalent allocations designed with a goal to help clients capture higher short-term yields while maintaining liquidity and stability. However, they serve two distinct purposes:

- Cash Flow Strategy is for ongoing income needs, such as monthly withdrawals in retirement or other recurring distributions.

- Lump Sum Strategy is for specific future expenses, such as a home down payment, tax payments, or a major purchase 6 to 24 months out.

How Do They Work?

Each strategy is structured using a tiered bucket system, with allocations managed by our Investment Committee. The funds are invested in a mix of ultra-short-term, high-quality bond funds and cash equivalents, allowing you to earn a competitive yield while keeping the risk low.

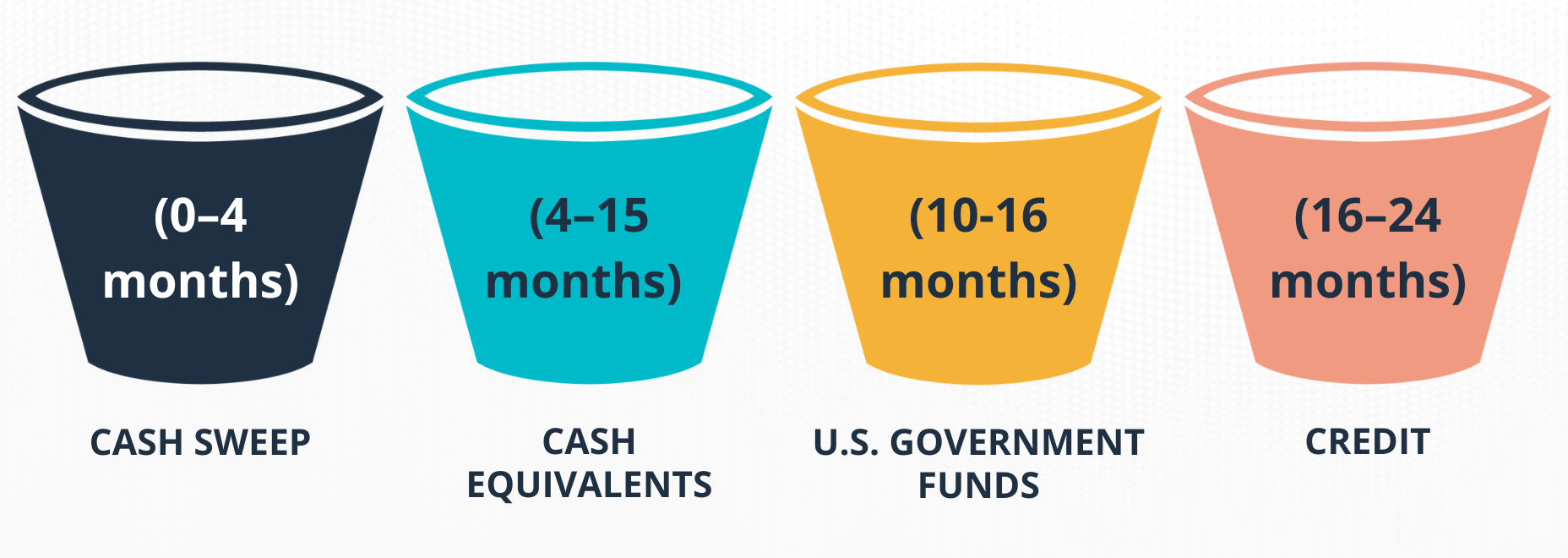

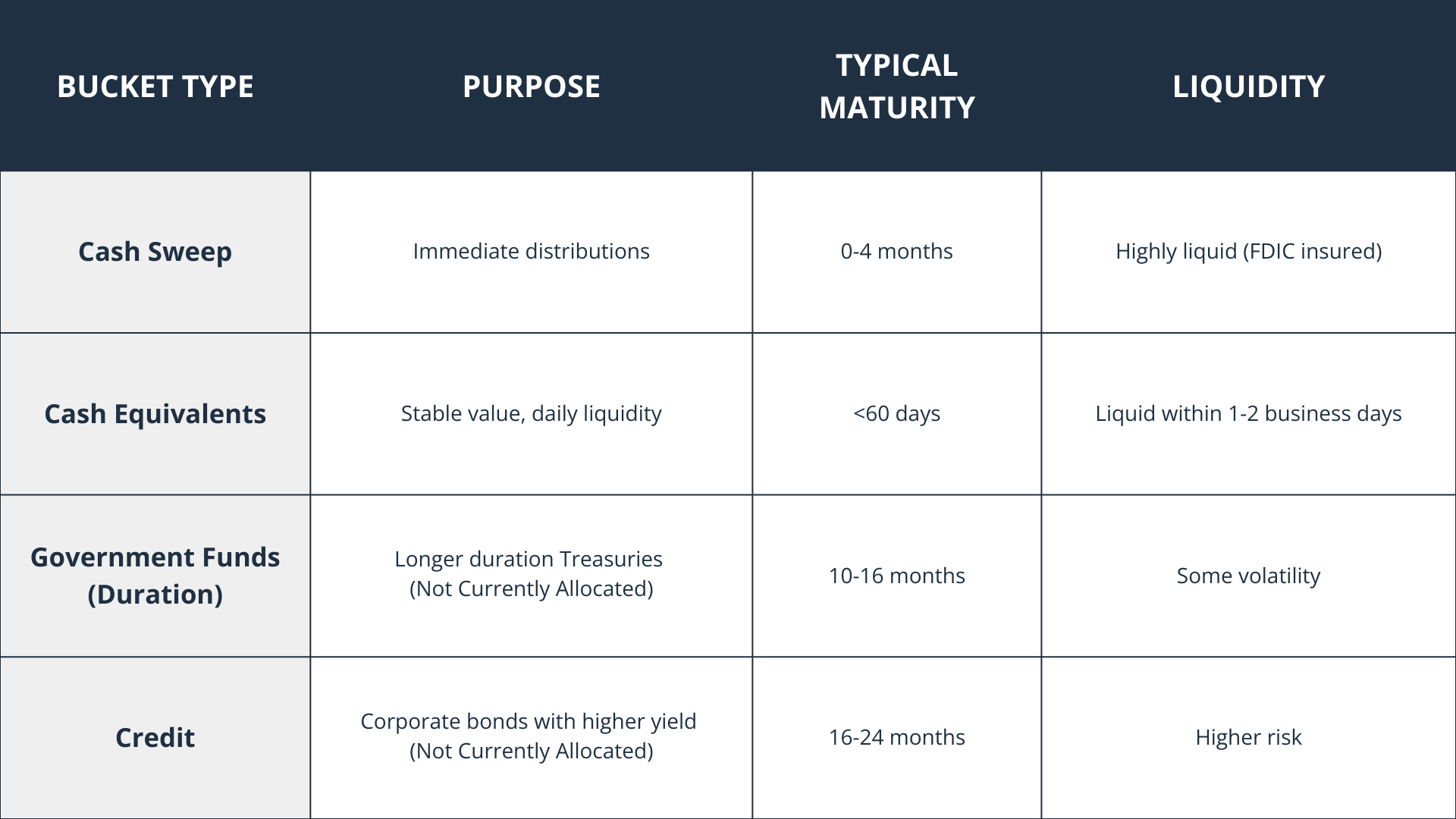

Both strategies use the same four investment buckets but are customized by time horizon and client-specific goals. Here is a breakdown of each bucket and its role within the strategies:

1. Cash Sweep (0–4 months)

- Purpose: Immediate liquidity

- Description: This bucket consists of FDIC-insured cash. It’s fully liquid and used for near-term distributions—typically covering 1 to 2 months of expenses in the Lump Sum Strategy and up to 4 months in the Cash Flow Strategy. This is your most accessible cash, designed to meet known, immediate needs.

- Why We Use It: It protects against the need to sell investments at an inopportune time and ensures quick access to funds.

2. Cash Equivalents (4–15 months)

- Purpose: Short-term stability with a yield advantage over traditional savings

- Description: This bucket is made up of high-quality, ultra-short-term bonds or money market funds with average maturities under 60 days. These investments aim to maintain a stable $1 value while earning a higher yield than FDIC-insured cash.

- Why We Use It: These instruments are low-risk and highly liquid, making them suitable for short-term needs while delivering higher interest income.

3. Government Duration (10–16 months)

- Purpose: Incremental return potential with modest volatility

- Description: This bucket contains U.S. government bonds with slightly longer maturities. These securities may have minor price fluctuations but offer a yield advantage when the interest rate outlook justifies extending duration.

- Why We Use It: When interest rates are expected to fall or stabilize, this bucket helps add return without taking on credit risk. We may hold this bucket selectively depending on the market environment.

4. Credit (16–24 months)

- Purpose: Higher return potential for mid-term needs

- Description: This bucket includes short-term corporate bonds. These offer higher yields than government securities but also carry credit risk. When credit spreads are attractive, this bucket adds value. When spreads are tight, as they are currently, we avoid this allocation.

- Why We Use It: When appropriately timed, it enhances returns without overextending risk. It is used only when the risk-reward tradeoff is favorable.

Here’s a simplified breakdown:

Making It Simple: A Helpful Analogy

To make the distinction even clearer, think of these two strategies like packing for a trip:

- The Cash Flow Strategy is your carry-on bag—it holds everything you need right away: monthly withdrawals, bills, and short-term expenses. It’s always close, easy to access, and organized to support your daily needs without touching your long-term investments.

- The Lump Sum Strategy is your checked luggage—it’s packed for something coming up later in the journey. Maybe it’s a major purchase, a home remodel, or another large one-time expense. You don’t need it today, but it needs to be ready when the time comes.

Both “bags” are thoughtfully packed to serve a specific purpose. By separating your short-term needs from your near-future plans, you avoid overloading your portfolio with cash—or worse, being forced to sell long-term investments at the wrong time.

When Is Each Strategy Appropriate?

- Use the Cash Flow Strategy if you:

- Are taking monthly or quarterly withdrawals

- Are in retirement and need predictable income

- Want to insulate your investment portfolio from market-driven withdrawals

- Use the Lump Sum Strategy if you:

- Have a known upcoming expense in 6–24 months

- Are saving for a home, wedding, remodel, or other large goal

- Don’t want to leave the money in a low-yield bank account but also don’t want the risk of the market

Cash Hub vs. Planning for the Future

The Cash Hub is part of our broader retirement income strategy. It represents a specific number of months’ worth of expenses we recommend keeping liquid to avoid selling long-term investments during downturns. For many retirees, we target 18 to 24 months of non-covered expenses in cash, creating a buffer for down markets.

The Lump Sum Strategy, on the other hand, is designed for one-time planned needs. Rather than letting those dollars sit idle in a checking account or risk losing value to inflation, we position the funds in a stable, managed solution.

Example: How a Client Might Use Both

Meet Sarah, age 62, recently retired. She has:

- $140,000 in cash from a recent bonus and stock option payout

- Monthly expenses of $10,000

- Social Security and a pension covering $6,000 per month

Her Plan:

- $96,000 goes to her Cash Flow Strategy (24 months of net cash needs: $10,000 – $6,000 = $4,000 × 24)

- $30,000 goes to her Lump Sum Strategy for a kitchen remodel in 18 months

- The rest stays in her investment portfolio for long-term growth potential

This allows Sarah to keep her distributions steady, avoid selling stocks in a downturn, and earn more on her near-term funds than she would at the bank.

Why Not Just Use a Savings Account or CD?

While savings accounts and CD’s offer less volatility, they fall short in three key areas:

- Low yields: Even high-yield savings accounts often return less than our managed strategies

- Inflexibility: CD’s lock your money for a set term, which may not align with your needs

- No strategy: Bank accounts are static. Our strategies are actively managed based on interest rates and your goals

That said, it’s important to note: unlike bank accounts, these funds must be sold before cash becomes available. However, the process is simple and only takes 1–2 business days to settle, and we handle the logistics for you.

Bottom Line: Purpose-Driven Cash Management

Your short-term cash shouldn’t be an afterthought. With thoughtful planning, strategic allocation, and active oversight, your money can stay accessible, and productive.

If you’re holding significant cash in the bank or unsure how to structure your liquidity, let’s talk about how these strategies can work for you.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss

Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value.

CDs are FDIC insured to specific limits and offer a fixed rate of return if held to maturity, whereas investing in securities is subject to market risk including loss of principal.

An investment in the Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing

From Firm to Family: Why Your Financial Plan Deserves a Team

At Gatewood Wealth Solutions, wealth management extends beyond mere numbers—it’s about relationships, trust, and commitment that span generations. Our distinctive Firm-to-Family model isn’t just a slogan; it’s the foundation of how we deliver lasting value across generations.

A Team Built Around You

Unlike traditional models where clients are tethered to a single advisor, Gatewood provides an integrated team of professionals, each with a specific role:

- Wealth Advisor: Your primary relationship manager, guiding significant financial decisions and ensuring your overall experience is seamless and attentive.

- Wealth Planner: A Certified Financial Planner® responsible for crafting and continuously refining your personalized financial plan, directly aligned with your life goals.

- Wealth Coordinator: The organizational anchor who manages administrative details, keeping your financial matters consistently organized and accessible.

- Specialists: Extra support for your plan from experienced teammates with deep understanding of specialized and complex topics.

Expertise That Grows with You

Beyond the core Client Care Team, we have a team of specialists in investments, tax, business, and estate planning. These professionals collaborate behind the scenes to address the complexities that come with growing wealth.

Whether you’re navigating a liquidity event, transitioning into retirement, or preparing your estate plan, our in-house specialists at Gatewood team are already in place—ready to step in and support you. No matter your life stage or estate size, the right expertise is readily available.

This approach helps keep your financial strategy on track through life’s transitions and unexpected turns—so you can move forward with greater clarity and confidence.

Tailored Services for Every Stage

We recognize the uniqueness of each client’s financial landscape. Our Client Care Teams are structured to reflect your specific financial complexity:

- Private Client Care: For ultra-high-net-worth individuals with complex, multifaceted financial needs.

- Client Care Plus: Designed to support high-net-worth families requiring comprehensive, strategic financial management.

- Client Care: Catering to clients with essential, yet crucial, financial planning needs.

By aligning our teams precisely with your financial circumstances, we ensure focused attention and optimal outcomes at every life stage.

The Firm-to-Family Advantage

Our Firm-to-Family approach means your relationship extends to the entire firm rather than depending solely on an individual advisor. This method provides:

- Consistency: Your financial strategy remains stable and continuous, even if team members evolve.

- Comprehensive Expertise: Immediate access to a collective wealth of knowledge from professionals who collaborate to serve your best interests.

- Generational Relationships: We aim not just to serve you, but to support your family’s financial health across multiple generations, establishing a legacy of security and growth.

How We Differ from Traditional Advisors

Many wealth management firms operate on a “book of business” or “my client” model, where clients rely exclusively on one advisor for their financial planning. The advisor may fly under the banner of a big national brand, but in reality, that advisor acts as a one-man band.

This traditional approach can create vulnerabilities, particularly if the advisor moves firms, retires, or experiences life changes. At Gatewood Wealth Solutions, we embrace an “our clients” culture, ensuring your relationship is with our entire firm. This commitment means you enjoy seamless continuity, collective expertise, and personalized attention from our dedicated team, free from the disruptions often associated with traditional, advisor-dependent models.

Real Stories, Lasting Impact

Clients frequently highlight the tangible benefits of our comprehensive approach:

“Our relationship with Gatewood Wealth Solutions has evolved over the years right along with our family. From building and protecting our wealth to retirement and estate planning, Gatewood has guided us and enabled our objectives. It’s reassuring to know skilled professionals we trust are working with us to optimize what we have worked for all our lives¹.” — Dr. Boyd C., Retired Corporate Executive

A Client Story: The Parkers’ Journey from Overwhelmed to Empowered

Before partnering with Gatewood, the Parker family—two busy professionals with three children and aging parents—felt stretched thin. Despite solid earnings, they were unsure how to balance college savings, retirement planning, elder care responsibilities, and managing their growing portfolio. Their previous advisor provided only occasional updates and general guidance, leaving them uncertain and reactive.

After engaging Gatewood Wealth Solutions, everything changed. They were introduced to their dedicated Client Care Team, including a Wealth Advisor who listened closely to their goals, a Wealth Planner who developed a dynamic, goal-driven plan, and a Wealth Coordinator who ensured nothing slipped through the cracks.

Behind the scenes, Gatewood’s investment, tax, and estate planning specialists collaborated to build a coordinated strategy. The Parkers refinanced underperforming real estate assets, implemented a multigenerational gifting strategy, optimized their retirement drawdown plan, and established an education trust for their children.

Today, the Parkers say they finally feel in control. They’re no longer juggling disconnected advice—they have a proactive team that meets with them regularly, answers questions before they even arise, and helps them make confident decisions.

Ready to Experience the Gatewood Difference?

If you seek a wealth management relationship built on enduring trust, tailored strategies, and a dedicated team focused on your family’s lasting financial success, we’re ready to start the conversation.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risks including possible loss of principal.

¹ This statement is a testimonial by a client of the financial professional as of 11/13/2023. The client has not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial. These views may not be representative of the views of other clients and are not indicative of future performance or success.

There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation do not protect against market risk.

The information provided here is general in nature. It is not intended, nor should it be construed, as legal or tax advice. To determine which strategies or investments may be suitable for you, consult the appropriate qualified professional prior to making a decision.

Expertise That Grows with You

Beyond the core Client Care Team, we have a team of specialists in investments, tax, business, and estate planning. These professionals collaborate behind the scenes to address the complexities that come with growing wealth.

Whether you’re navigating a liquidity event, transitioning into retirement, or preparing your estate plan, our in-house specialists at Gatewood team are already in place—ready to step in and support you. No matter your life stage or estate size, the right expertise is readily available.

This approach helps keep your financial strategy on track through life’s transitions and unexpected turns—so you can move forward with greater clarity and confidence.

Tailored Services for Every Stage

We recognize the uniqueness of each client’s financial landscape. Our Client Care Teams are structured to reflect your specific financial complexity:

- Private Client Care: For ultra-high-net-worth individuals with complex, multifaceted financial needs.

- Client Care Plus: Designed to support high-net-worth families requiring comprehensive, strategic financial management.

- Client Care: Catering to clients with essential, yet crucial, financial planning needs.

By aligning our teams precisely with your financial circumstances, we ensure focused attention and optimal outcomes at every life stage.

The Firm-to-Family Advantage

Our Firm-to-Family approach means your relationship extends to the entire firm rather than depending solely on an individual advisor. This method provides:

- Consistency: Your financial strategy remains stable and continuous, even if team members evolve.

- Comprehensive Expertise: Immediate access to a collective wealth of knowledge from professionals who collaborate to serve your best interests.

- Generational Relationships: We aim not just to serve you, but to support your family’s financial health across multiple generations, establishing a legacy of security and growth.

How We Differ from Traditional Advisors

Many wealth management firms operate on a “book of business” or “my client” model, where clients rely exclusively on one advisor for their financial planning. The advisor may fly under the banner of a big national brand, but in reality, that advisor acts as a one-man band.

This traditional approach can create vulnerabilities, particularly if the advisor moves firms, retires, or experiences life changes. At Gatewood Wealth Solutions, we embrace an “our clients” culture, ensuring your relationship is with our entire firm. This commitment means you enjoy seamless continuity, collective expertise, and personalized attention from our dedicated team, free from the disruptions often associated with traditional, advisor-dependent models.

Real Stories, Lasting Impact

Clients frequently highlight the tangible benefits of our comprehensive approach:

“Our relationship with Gatewood Wealth Solutions has evolved over the years right along with our family. From building and protecting our wealth to retirement and estate planning, Gatewood has guided us and enabled our objectives. It’s reassuring to know skilled professionals we trust are working with us to optimize what we have worked for all our lives¹.” — Dr. Boyd C., Retired Corporate Executive

A Client Story: The Parkers’ Journey from Overwhelmed to Empowered

Before partnering with Gatewood, the Parker family—two busy professionals with three children and aging parents—felt stretched thin. Despite solid earnings, they were unsure how to balance college savings, retirement planning, elder care responsibilities, and managing their growing portfolio. Their previous advisor provided only occasional updates and general guidance, leaving them uncertain and reactive.

After engaging Gatewood Wealth Solutions, everything changed. They were introduced to their dedicated Client Care Team, including a Wealth Advisor who listened closely to their goals, a Wealth Planner who developed a dynamic, goal-driven plan, and a Wealth Coordinator who ensured nothing slipped through the cracks.

Behind the scenes, Gatewood’s investment, tax, and estate planning specialists collaborated to build a coordinated strategy. The Parkers refinanced underperforming real estate assets, implemented a multigenerational gifting strategy, optimized their retirement drawdown plan, and established an education trust for their children.

Today, the Parkers say they finally feel in control. They’re no longer juggling disconnected advice—they have a proactive team that meets with them regularly, answers questions before they even arise, and helps them make confident decisions.

Ready to Experience the Gatewood Difference?

If you seek a wealth management relationship built on enduring trust, tailored strategies, and a dedicated team focused on your family’s lasting financial success, we’re ready to start the conversation.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risks including possible loss of principal.

¹ This statement is a testimonial by a client of the financial professional as of 11/13/2023. The client has not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial. These views may not be representative of the views of other clients and are not indicative of future performance or success.

There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation do not protect against market risk.

The information provided here is general in nature. It is not intended, nor should it be construed, as legal or tax advice. To determine which strategies or investments may be suitable for you, consult the appropriate qualified professional prior to making a decision.

How One Business Owner Saved Over $12K by Electing S-Corp Status

When Mike started his consulting business, he did what many new entrepreneurs do—he operated as a sole proprietor. It was simple, required no formal setup, and allowed him to focus on building his client base.

But two years in, with business booming and $200,000 in net income on the books, Mike’s CPA asked a pivotal question:

“Have you thought about electing to be taxed as an S-corporation?”

Mike had heard the term before but didn’t quite understand how it worked—or why it mattered. What followed was an analysis that changed the way Mike ran his business and saved him thousands of dollars every year.

The Tax Breakdown: Sole Proprietor vs. S-Corp

As a sole proprietor, Mike was paying self-employment tax on every dollar of his $200,000 net income. That meant:

- Sole Proprietor Self-Employment Tax:

$200,000 × 15.3% (Social Security + Medicare) = $30,600

Ouch.

But under an S-Corp structure, things look different. Mike would pay himself a reasonable salary (let’s say $96,000) and take the rest of the profit ($104,000) as a distribution, which isn’t subject to self-employment taxes.

Here’s how the S-Corp scenario plays out:

- S-Corp Employment Tax on Salary:

$96,000 × 15.3% = $14,688 - Remaining $104,000 in profit is not subject to employment tax.

- Tax Savings:

$30,600 (Sole Proprietor) – $14,688 (S-Corp) = $15,912 saved

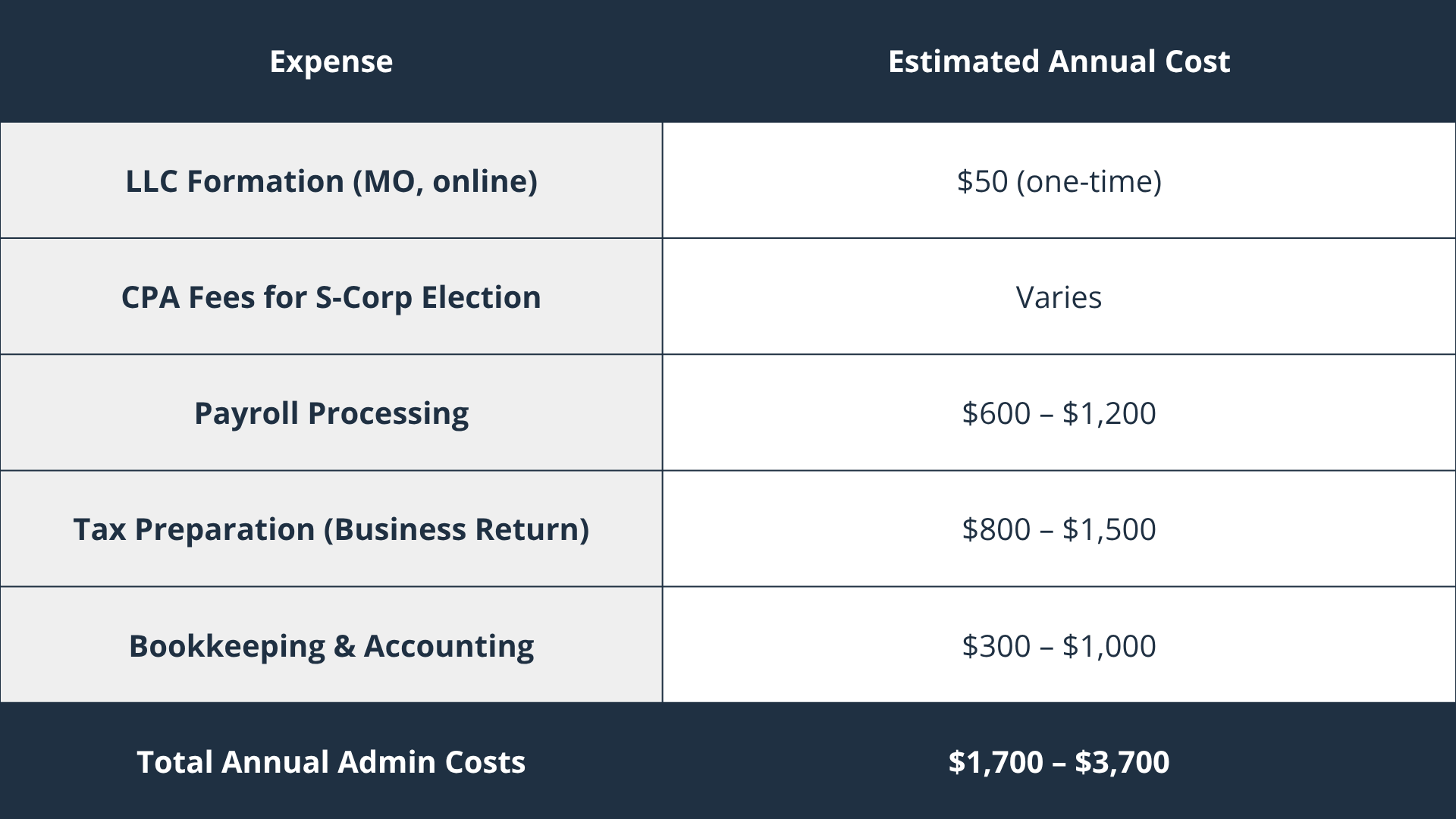

The Cost of Making the Switch

Of course, S-corporation status comes with a few additional administrative requirements:

Even after subtracting these estimated costs, Mike stood to save between $12,212 and $14,212 per year.

Bonus Tax Benefit: State Income Tax Deduction

But that’s not all. Because S-corps are pass-through entities, Mike also became eligible for Missouri’s pass-through entity tax election, allowing state taxes to be paid at the business level—rather than being limited to the $10,000 SALT deduction cap on his personal return.

This strategy gave Mike additional federal tax savings, since he could now fully deduct state taxes paid by the S-corp.

Other Advantages of Being an S-Corporation

Beyond tax savings, Mike discovered several practical and strategic benefits:

- Professionalism: Operating as an S-Corp signaled to clients and vendors that his business was established and credible.

- Liability Protection: As an LLC electing S-Corp status, he gained legal separation between personal and business assets.

- Retirement Contributions: With W-2 wages, Mike could contribute more to certain retirement plans (like a solo 401(k)).

- Ownership Flexibility: He could bring on other shareholders or investors without reworking the business structure.

- Improved Bookkeeping Discipline: Payroll, regular compensation, and distributions helped him create clearer financial records—critical for future growth or financing.

Additional Considerations When Converting to an S-Corporation

Fringe Benefits May Be Less Favorable

S-corporation owners who hold more than 2% of the company are treated differently than sole proprietors or C-corporation owners when it comes to fringe benefits.

- For example, health insurance premiums must be included in the shareholder’s W-2 wages and deducted on their individual return—not the business return.

- This approach does not reduce FICA taxes and can limit the overall tax benefit.

- The same applies to HSA contributions and certain other fringe benefits, which may not be deductible at the entity level.

Reasonable Compensation Is Required

The IRS requires that S-Corp shareholder-employees pay themselves a reasonable wage before taking distributions. This is a common IRS audit focus.

Tip: A reasonable salary should be based on industry standards, the services performed, and the time spent working in the business. In our earlier example, $96,000 appears reasonable—but this figure should be justified and documented.

State Tax Workaround – SALT Cap (PTE Election)

Some states, including Missouri, allow Pass-Through Entity (PTE) tax elections, which can help bypass the federal $10,000 cap on state and local tax (SALT) deductions.

However, this strategy comes with caveats:

- The election must be made annually and on time.

- It isn’t always beneficial, depending on whether you itemize deductions and your income level.

- Not all states allow this workaround, so consult your tax advisor to see if it applies.

Tracking Basis and Distribution Rules

S-Corp shareholders must carefully track their basis (i.e., their investment in the company).

- Distributions in excess of basis are taxable.

- Losses may be disallowed if the shareholder doesn’t have enough basis to absorb them. This becomes more complex if the business has significant debt, inventory, or variable income.

Timeline for Electing S-Corp Status

To be effective for the current tax year, you must file Form 2553 by March 15.

- If you miss the deadline, you may still qualify for late election relief, but you’ll need to follow IRS procedures.

Exit Strategy and Flexibility

S-Corp status is relatively easy to revoke if your situation changes. However, once revoked, you generally cannot re-elect S-Corp status for five years without IRS approval.

Bottom Line: Is It Time to Make the Switch?

For Mike, the math was simple: Save over $12,000 a year, protect personal assets, and run a more structured, scalable business.

If you’re earning over $50,000–$60,000 in annual net income, talk to your CPA or financial advisor about whether electing S-Corp status could be right for you. With the right structure and planning, you may save thousands each year in taxes—while building a more scalable and protected business. For many small business owners, this single decision can meaningfully boost profitability and financial efficiency—without changing the work you do.

Want to explore whether switching to an S-Corp could save you thousands too? Let’s talk.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for individualized tax advice. We suggest that you discuss your specific tax situation with a qualified tax advisor.

This is a hypothetical example and is not representative of any specific situation. Your results will vary.

What Happens in Your House Is More Important Than the White House

Tariffs. Tax policy. Trump.

Turn on the news and you’ll be flooded with political noise—but let’s cut through the clutter:

What matters most to your family’s financial future isn’t in Washington, D.C.—it’s within your own four walls.

At Gatewood, we help families shift their focus away from the headlines they can’t control and toward the household habits they can. While income tends to steal the spotlight, spending is the real unsung hero of long-term financial independence. Most financial advisors avoid talking about spending—it can feel too personal, too awkward. They fear upsetting clients by confronting sensitive realities. But not us. We believe in honest conversations because financial discipline today lays the foundation for your family’s future freedom.

Understanding the Budgeting Landscape

Clients often ask us: “How much should I spend on housing?” or “Am I saving enough?”

To help answer these, here’s a comparison of how three well-known frameworks—Dave Ramsey, the CFP Board, and CFA-informed guidance—stack up:

| Category | Dave Ramsey | CFP Board | CFA-Informed |

| 🏠 Housing & Utilities | 25% | ≤ 28% | 25–30% |

| 🚗 Transportation | 10–15% | ≤ 15% | 10–15% |

| 🍽️ Food & Groceries | 10–15% | 10–15% | 10–15% |

| ⚕️ Health Care | 5–10% | 5–10% | 5–10% |

| 🎓 Education & Childcare | 5–10% | 5–10% | 5–10% |

| 💳 Consumer Debt | 0% | ≤ 10% | ≤ 10% |

| 💰 Total Debt (incl. housing) | ≤ 35–40% | ≤ 36% | ≤ 36–40% |

| 🎭 Entertainment & Personal | 5–10% | 5–10% | 5–10% |

| 🛠️ Miscellaneous | Included in personal | 5–10% | 5–10% |

| 🛡️ Savings, Insurance, and Investments | 10–15%+ | 10–20% | ≥ 15–20% |

| 💝 Giving & Charity | 10% recommended | 5–10% (flexible) | 5–10% (flexible) |

Key Differences:

- Dave Ramsey: Strict, debt-focused with a heavy emphasis on giving and zero-based budgeting

- CFP Board: Offers guardrails with room to personalize

- CFA-Informed: Focuses on principles like discipline, long-term growth, and risk alignment (Ex: Budgeting isn’t about rigid rules—it’s about aligning your resources with your values, goals, and risk tolerance.)

The Gatewood Family Budgeting Guidelines

At Gatewood, we synthesized the best of all approaches and added real-life insight. Here’s our proprietary guide we call The Gatewood Family Budgeting Guidelines:

| Category | Gatewood Target (±5%) |

| 🏠 Housing & Utilities | 25% |

| 🚗 Transportation | 10% |

| 🍽️ Food & Groceries | 10% |

| ⚕️ Health Care | 7.5% |

| 🎓 Education & Childcare | 7.5% |

| 💳 Consumer Debt | 0% (yes, zero!) |

| 💰 Total Debt (incl. housing) | 25% |

| 🎭 Entertainment & Personal | 5% |

| 🛠️ Miscellaneous | 5% |

| 🛡️ Savings, Insurance, and Investments | 20% (go for more!) |

| 💝 Giving & Charity | 10% |

A Look Inside Our Home: My Family’s Budget Case Study

We don’t just preach these principles—we live them. Here’s a transparent look at how my family’s real monthly spending lines up with our own guidelines (below). These figures are after our 401(k) and HSA contributions are maximized. As you will see, the Goeddel family is far from perfect! I hope sharing this information and being vulnerable is helpful to you and your family.

| Category | Gatewood Guidelines (%) | Actual Family Spending ($) | Actual Family Spending % | Notes |

| 🏠 Housing & Utilities | 25% | $8,400 | 34% | $7,000 mortgage plus extra principal payments; $1,400 bills & utilities |

| 🚗 Transportation | 10% | $500 | 2% | Just gas—no car payments |

| 🍽️ Food & Groceries | 10% | $3,300 | 13% | $2,500 groceries, $600 dining out or delivery, $200 coffee |

| ⚕️ Health Care | 7.5% | $500 | 2% | Out-of-pocket medical |

| 🎓 Education & Childcare | 7.5% | $2,000 | 8% | 529 Plan contributions for two kids |

| 💳 Consumer Debt | 0% | $0 | 0% | None! |

| 💰 Total Debt | 25% | $7,000 | 28% | Mortgage |

| 🎭 Entertainment & Personal | 5% | $3,400 | 14% | Amazon, clothes, date nights, personal care, pets |

| 🛠️ Miscellaneous | 5% | $1,500 | 6% | Unplanned monthly expenses |

| 🛡️ Savings, Insurance, and Investments | 20% | $3,000 | 12% | Trust contributions + full insurance suite |

| 💝 Giving & Charity | 10% | $2,400 | 10% | Charitable giving + gifts to family/friends |

A Few Highlights

Where We’re Winning

- Mortgage is our only debt

- Long-term savings and insurance plans are in place

Where We’re Improving

- Reducing “Entertainment & Personal” (Amazon!!!) and “Miscellaneous”

- Increasing savings beyond the 401(k) closer to 20%

Take Control of Your Financial Future

Financial freedom isn’t found in the headlines—it’s built through intentional habits, month after month. At Gatewood, we help families match their money with their values—so they can create meaningful wealth and lasting legacies.

Ready to align your budget with your future? Let’s talk. We’re here to help.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

Dave Ramsey is not affiliated with or endorsed by LPL Financial and Gatewood.

Still Working, Still Planning: Why In-Service Distributions Can Be a Game Changer

For high-earning professionals, retirement isn’t a date—it’s a strategy. And one of the most overlooked ways to take control of that strategy, even while you’re still working, is through an in-service distribution (ISD).

We’re often asked this question:

“Can I move my 401(k) into an IRA while I’m still working—so I can take full advantage of active, personalized portfolio management?”

In many cases, the answer is yes. And when done strategically, it can unlock greater control, tax advantages, and long-term flexibility.

Let’s explore how in-service distributions work—and when they make sense as part of a bigger-picture plan for your future.

What You Gain with an In-Service Distribution?

An in-service distribution allows you to move all or part of your 401(k), 403(b), or pension assets into an IRA—without leaving your job. As long as the transfer is done as a direct rollover, your funds retain their tax-deferred status and the transaction is not taxable.

The IRS permits in-service distributions from:

- 401(k) or 403(b) plans once the participant reaches age 59½

- Defined benefit pensions or profit-sharing plans, sometimes at earlier ages (e.g., age 55 or based on years of service), depending on the plan document

But just because you can, doesn’t always mean you should—yet for many executives, this move creates flexibility, personalization, and greater alignment with long-term goals.

A Tale of Two Executives

Consider the stories of Michael and Susan, both successful professionals at different stages in their careers:

MICHAEL, age 59½, is a senior vice president who has spent 25 years with his company. He’s still passionate about his work but is beginning to think about his long-term financial independence. His 401(k) has grown substantially, but he feels limited by the investment options in the plan.

Because his plan allows for in-service distributions at 59½, Michael transfers a portion of his account into an IRA, enabling Gatewood’s investment team to tailor his strategy, diversify his portfolio, and begin creating a tax-smart income plan for future retirement.

SUSAN, age 67, is a chief operating officer who planned to retire at 65 but has decided to continue working for a few more years. She wants to avoid unnecessary risk and better align her retirement assets with her estate plan.

Her company’s retirement plan permits in-service distributions after age 65, and she uses the opportunity to roll assets into a professionally managed IRA. This move gives her more flexibility in charitable giving, Required Minimum Distribution (RMD) planning, and tax-efficient withdrawals—while continuing to contribute to her 401(k).

Questions to Consider Before Making an In-Service Distribution

- Does your employer’s retirement plan allow in-service distributions?

Not all plans offer this option, so the first step is to confirm availability through your plan documents or HR department. - Are you old enough to qualify?

Most 401(k) and 403(b) plans require that you reach age 59½ to take an in-service distribution without penalty. Some profit-sharing or pension plans may allow earlier access based on years of service. - Would you benefit from broader investment flexibility?

Employer plans typically offer a limited set of investment options. Rolling assets into an IRA can provide access to a wider range of strategies aligned with your goals and risk tolerance. - Do you want more active portfolio management?

If your plan is passively managed or lacks personalization, an IRA under Gatewood’s management may offer more proactive oversight and strategic alignment with your financial plan. - Are you looking to incorporate advanced tax strategies?

IRAs can unlock planning opportunities like Roth conversions, tax-efficient withdrawals, and Qualified Charitable Distributions (QCDs), which are harder to implement inside a 401(k). - Are you preparing for retirement and want to build a withdrawal or legacy strategy?

Making the move early can simplify your transition into retirement and help ensure your assets are structured for income, estate planning, and long-term preservation.

If you answered “yes” to more than one of these questions, an in-service distribution may be a valuable next step.

The Strategic Advantages & Smart Tradeoffs

The Advantages

Rolling assets into a Gatewood-managed IRA opens the door to a more expansive investment toolkit. Gone are the one-size-fits-all fund menus. Instead, you gain access to custom portfolios built with individual securities, ETFs, and even alternative investments—crafted around your objectives.

You also unlock:

- More proactive risk management

- Integrated tax planning (Roth conversions, QCDs, and withdrawal sequencing)

- Simplified estate coordination and beneficiary alignment

- Continued creditor protection under federal bankruptcy law, if the IRA is classified as a rollover*

*Note: Gatewood helps ensure that rollovers retain their ERISA-level protections by correctly classifying and documenting IRA rollovers.

Important Considerations

While an in-service distribution provides significant advantages, there are tradeoffs to be aware of:

- You lose access to 401(k) loan features. For most executives over 59½, this is rarely a material concern.

- Rollover IRAs¹ do not fall under ERISA’s federal creditor protections (outside of bankruptcy), which could matter in high-liability professions. We’ll help you evaluate based on your state’s protections and profession.

- IRAs require RMDs at age 73—even if you’re still working. In contrast, some 401(k)s let you defer RMDs while employed.

When Your Current Plan May Be Good Enough (For Now)

If your employer’s plan offers strong investment options, low costs, and you’re not yet focused on tax strategy or estate planning, staying the course may be appropriate—at least for now.

But if you’ve outgrown the plan’s limits, and want more alignment with your total financial life, then an in-service rollover may offer the clarity, control, and customization you deserve.

Why Gatewood for In-Service Distribution Management?

At Gatewood Wealth Solutions, we don’t just manage investments—we guide families through life’s most important financial transitions. Our in-service distribution process reflects that philosophy.

With us, you gain:

- A firm-to-family relationship built on trust, care, and your long-term purpose

- Integrated planning through our Total Client Deliverable—investments, cash flow, tax, and estate strategy in one plan

- An investment philosophy that focuses on risk management and long-term confidence

- No longer stuck with one-size-fits-all fund menu

- Disciplined, proactive management that evolves with your life and the market

- Clarity and confidence to navigate IRS rules, retirement timing, and plan complexity

Final Thought: It’s Not About Leaving Your Job. It’s About Taking Control.

Taking an in-service distribution isn’t about leaving your employer—it’s about taking control of your financial future.

If you’re ready for more flexibility, more strategy, and more confidence in your retirement plan, let’s start the conversation.

Your future self will thank you.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC

¹A plan participant leaving an employer typically has four options (and may engage in a combination of these options): 1. Leave the money in their former employer’s plan, if permitted; 2. Roll over the assets to their new employer’s plan, if one is available and rollovers are permitted; 3. Roll over to an IRA; or 4. Cash out the account value (38-LPL) show less

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply. Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA. Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

The 9 Essentials Every Thoughtful Estate Plan Should Include

The Unfinished Plan

David and Michelle are in their early 50’s, juggling successful careers, two teenagers, and aging parents who are starting to need more care. Like many, they meant to revisit their estate plan, but life got in the way. Their will is nearly a decade old. Their home is titled only in Michelle’s name. And their IRA beneficiaries haven’t been reviewed since David switched jobs.

They know planning is important. But between work and family, it’s hard to make the time.

Then imagine a sudden accident. Would Michelle be able to access David’s accounts or make medical decisions? Would their kids be placed with the right guardians? Without updated documents, their family could be left in legal limbo during one of the most difficult times.

What Is Estate Planning Really About?

Estate planning isn’t just for the wealthy. It’s for anyone who wants to protect the people they love and leave behind clarity instead of chaos. It involves deciding who will manage your assets, how they’ll be distributed, and who will make decisions if you can’t.

More than anything, it’s an act of care.

-

Understand Probate and How to Avoid It

Probate is a public, court-supervised process for settling estates. It can be expensive and slow. Tools like revocable trusts, joint account titling, and beneficiary designations can reduce or eliminate the need for probate.

-

Create or Update Your Will

Your will names guardians for minor children and explains how you want your assets distributed. While it doesn’t avoid probate, it gives clear instructions and can help reduce family conflict.

-

Check Your Beneficiaries and Account Titles

IRAs, 401(k)s, insurance policies, and even bank accounts can have named beneficiaries or be set up as transfer-on-death (TOD). Review these regularly—especially after marriage, divorce, or the birth of a child.