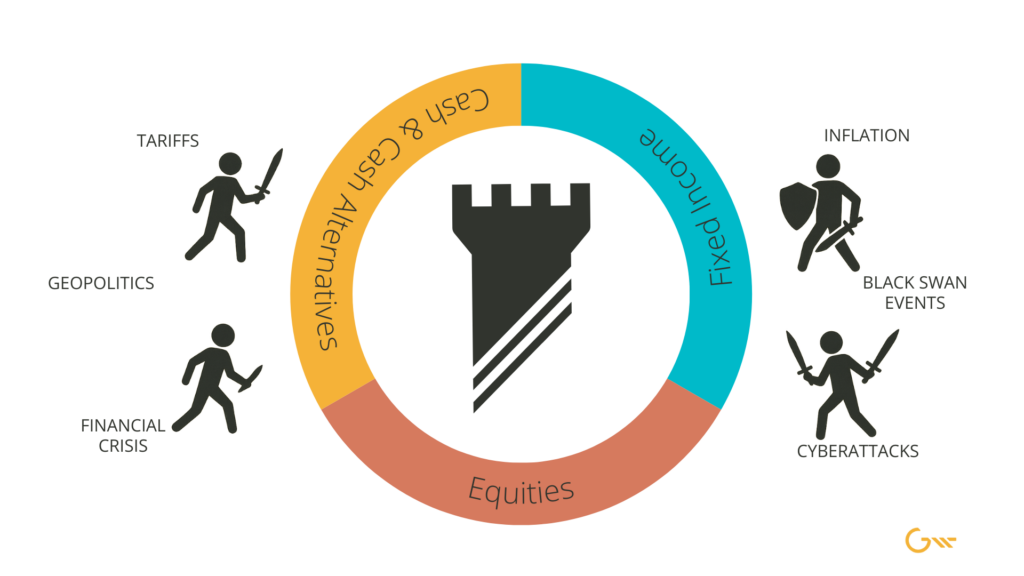

When markets drop sharply—like they did in response to the latest Trump tariff announcements—emotions run high, headlines swirl, and investors often make costly decisions. We get it. Downturns feel uncomfortable, especially when they’re fast, steep, or prolonged.

But here’s what we know from decades of managing wealth through every kind of market cycle: the worst days in the market are often immediately followed by the best. Panic may feel natural—but it’s rarely profitable.

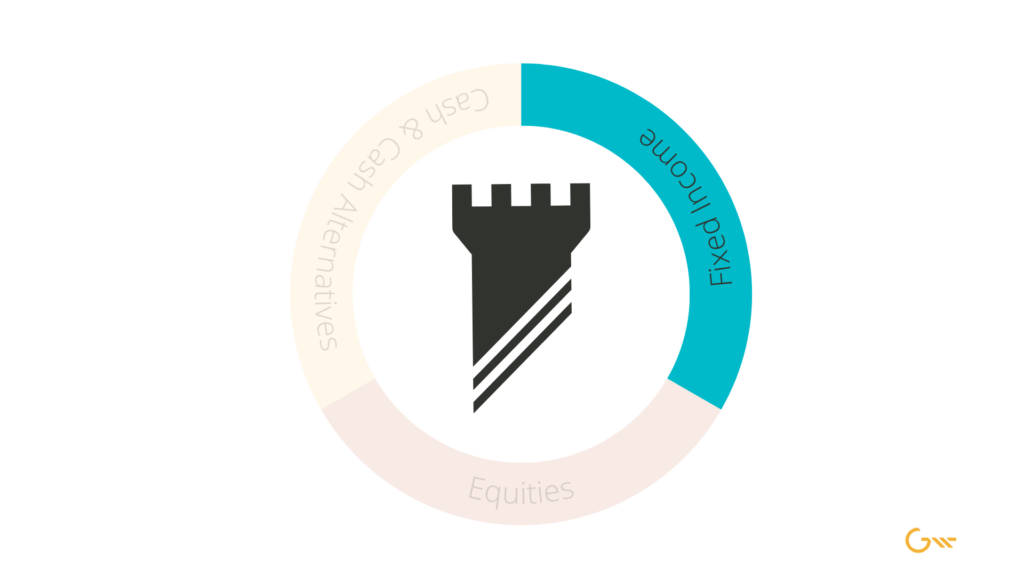

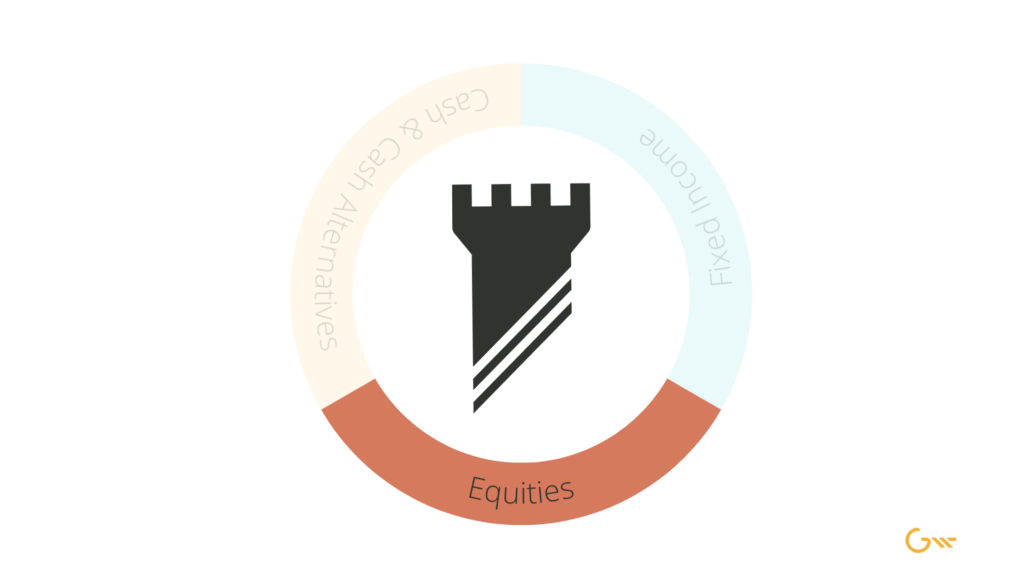

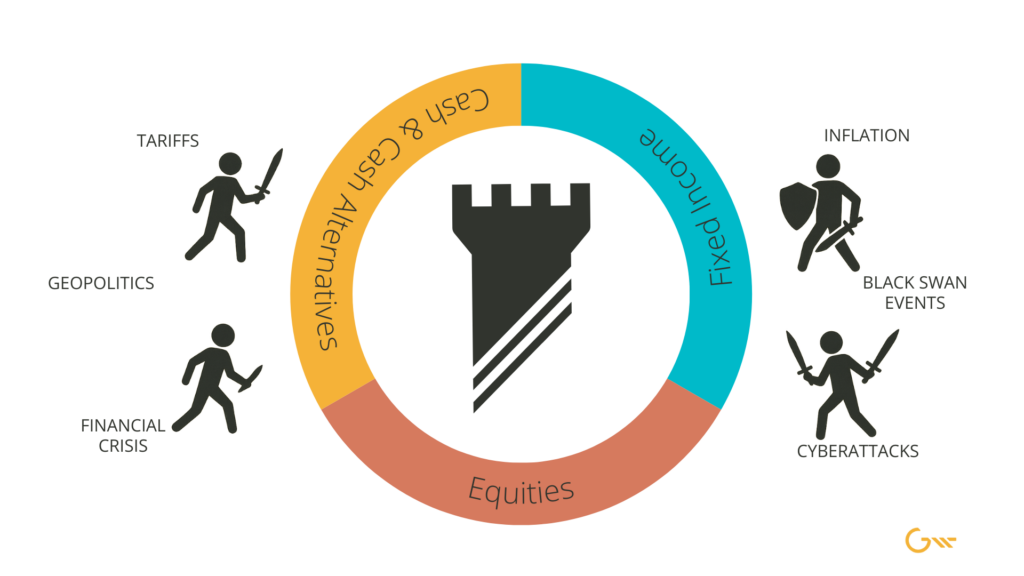

At Gatewood Wealth Solutions, we don’t just react to volatility. We prepare for it. That’s why every client benefits from our time-tested approach we call Fortress Gatewood—a strategy purpose-built to keep you Bear Market Ready.

A Strategy Built for Uncertainty

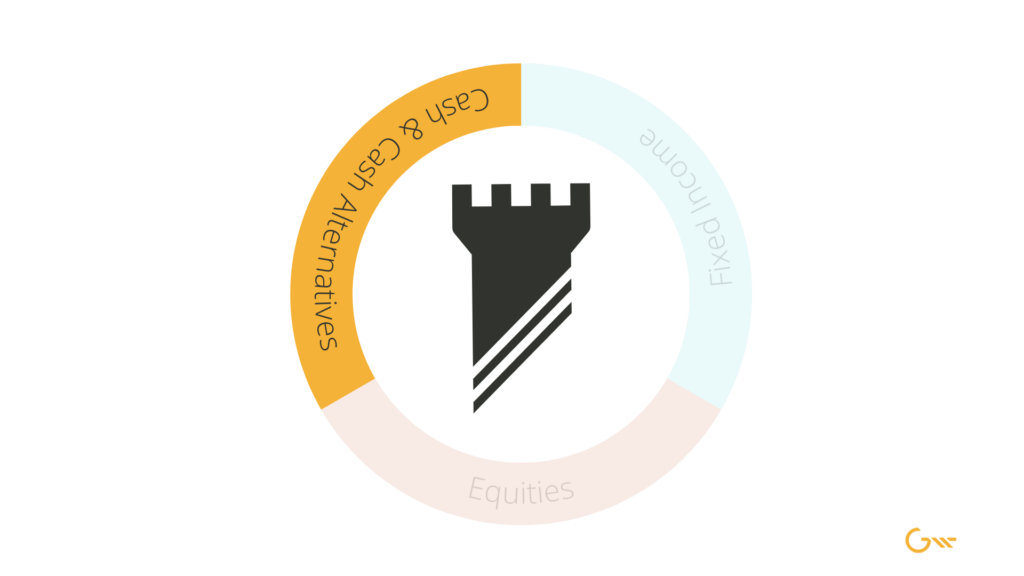

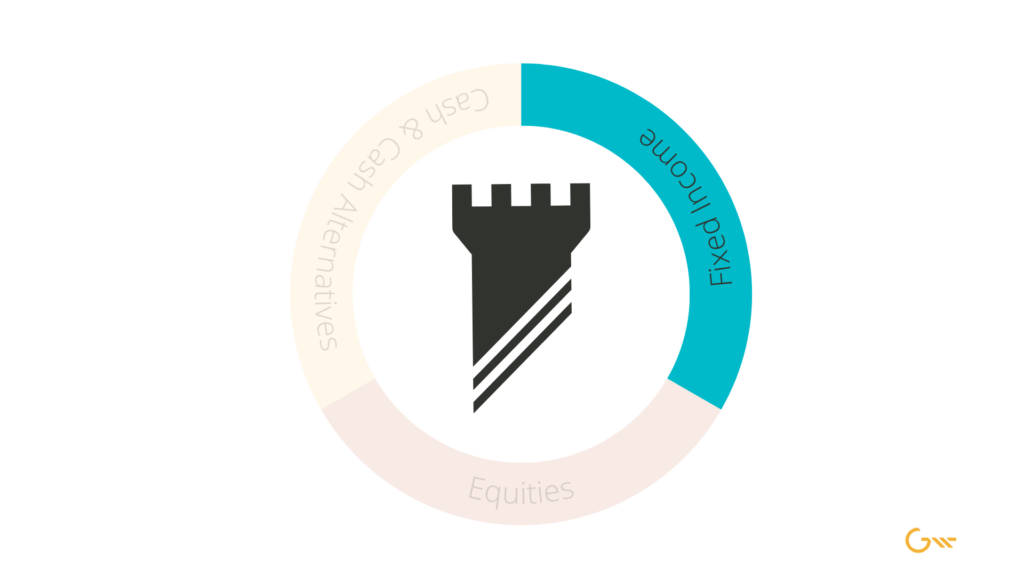

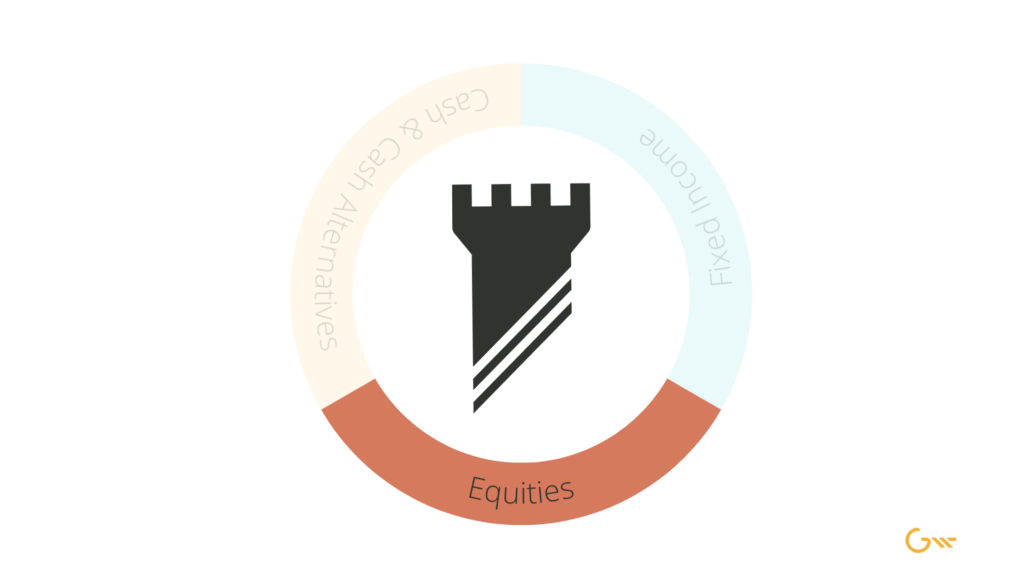

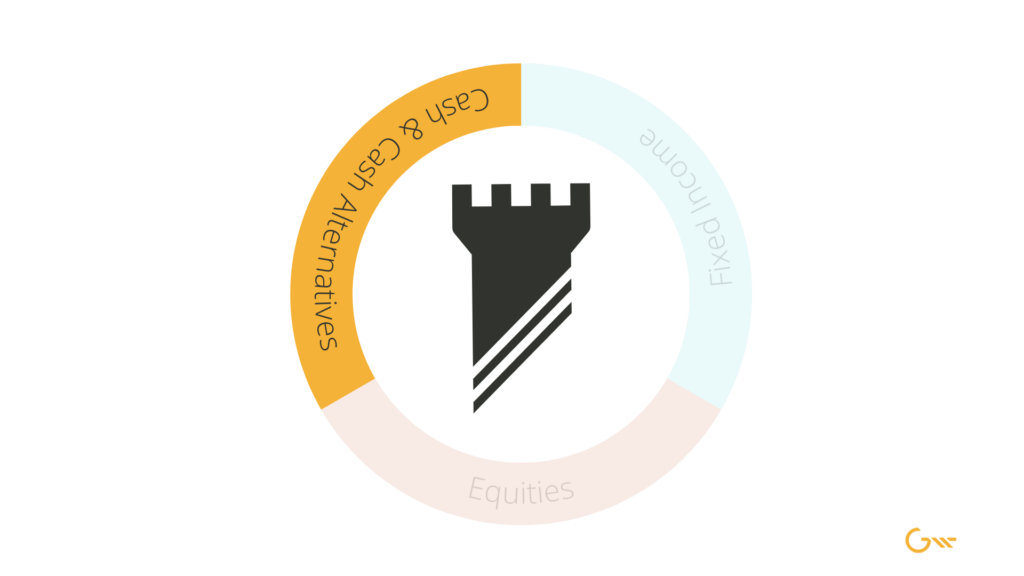

Rather than try to predict the unpredictable, Fortress Gatewood is designed to weather storms, seize opportunities, and help you avoid panic-driven mistakes. It’s not just a mindset—it’s a structured plan built around time segmentation that gives each dollar a purpose and timeline:

Moat Ring 1: Cash (Immediate Preservation)

We recommend clients hold at least 2 years of spending in cash or cash alternatives. This liquidity buffer is your first line of defense—so you don’t have to sell investments during a downturn just to fund your life.

Moat Ring 2: Fixed Income (Mid-Term Stability)

We allocate 5–8 years of spending in high-quality fixed income. Bonds act as a second moat, with a goal of offering stability and income while giving your equities the time they need to rebound.

Moat Ring 3: Equities (Long-Term Growth)

The rest of your portfolio is positioned for growth, invested in globally diversified equities with a 7–10 year time horizon. This long view helps you stay focused on your goals—not the day-to-day headlines.

Why This Works—Even in the Worst of Times

Here’s what history tells us about market declines and recoveries:

- Dot-Com Crash (2000–2002): -49.1% decline | 7.2 years to full recovery

- Global Financial Crisis (2007–2009): -56.8% decline | 5.5 years to recovery

- COVID-19 Crash (2020): -34% decline | Full recovery in ~6 months

- 2022 Bear Market: -27.55% | Recovery still underway

With 2 years of cash and 5–8 years of bonds, our clients don’t need to tap into their equity investments during downturns. That means they can remain confidently invested—giving their portfolios the opportunity needed for recovery and growth potential.

Why It Matters Now

In times like this, when fear creeps in and markets swing wildly on breaking headlines (even false ones), our clients know they’re not at the mercy of the market. They have a strategy, a plan, and a team. Rather than letting complacency take root during the good times at all-time market highs, they set aside profits to strengthen their defenses.

They’re not guessing. They’re prepared.

The Gatewood Difference

While others try to time the market or soothe with empty platitudes, we provide clarity, structure, and a strategy built with a goal to endure. Fortress Gatewood helps you weather volatility, stay aligned with your long-term goals, and build lasting wealth with confidence.

Because we believe your financial future deserves more than just hope—it deserves a fortress.

Important Clarification on Life Stage Strategy

Fortress Gatewood strategy is built around aligning your portfolio with your personal time horizon, income needs, and life stage. While the 2 years of cash and 5–8 years of bonds approach is ideal for clients in or near retirement—who are actively drawing from their portfolio—it’s not a one-size-fits-all model.

For younger clients who are still in their earning and accumulation years, we typically recommend a higher allocation to equities and lower levels of cash and bonds, since their income covers current expenses and their investment time horizon is longer. That said, maintaining strategic cash reserves (typically 3–6 months of living expenses) is still critical for emergencies and flexibility.

The core principle remains: structure your portfolio so you don’t need to sell during a downturn. Whether you’re accumulating or withdrawing, Fortress Gatewood adapts to give you confidence and preservation—tailored to your life stage.

Ready to Build Your Financial Fortress?

If you’re tired of reacting to markets and ready to plan with purpose, let’s talk. Our team can help you build a resilient strategy—one that’s designed with a goal to keep you confidently invested through whatever the future holds.

Contact us today to see how Fortress Gatewood can support your goals, your confidence in the long-term, and your family’s financial future.