When it comes to investing, simplicity and discipline often outperform complexity and constant tinkering. Few voices in financial planning have championed this notion more effectively than Nick Murray, one of the most respected minds in wealth management. His philosophy centers on long-term equity investing, behavioral discipline, and the idea that financial advisors are coaches, not market forecasters.

At Gatewood, we embrace many of these foundational principles while adding our own personalized approach to support our clients’ goals in building enduring wealth aligned with their values and purpose.

Nick Murray’s Core Principles of the “Ideal Portfolio”

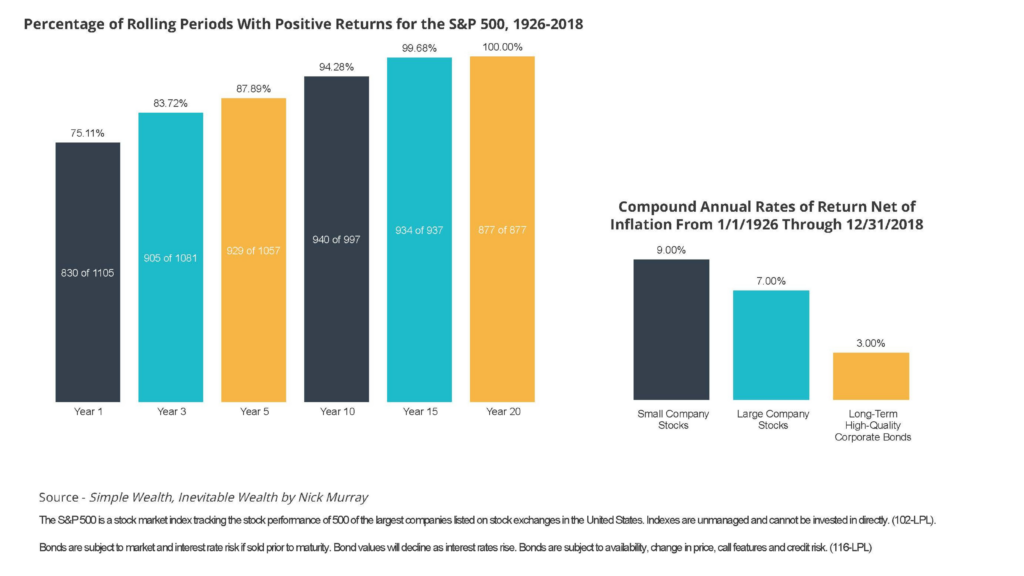

- Equities Are the Best Path to Long-Term Wealth

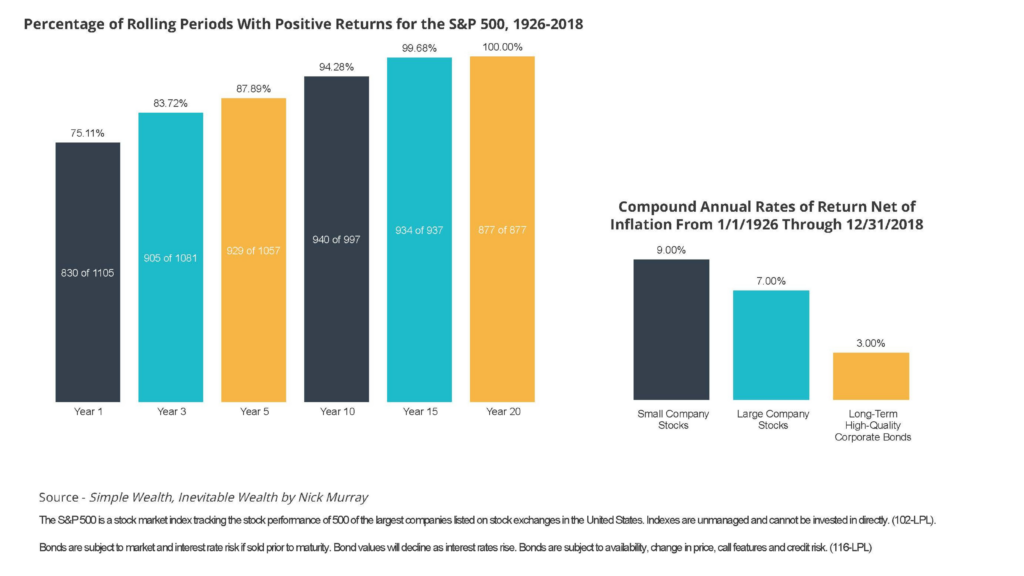

Murray firmly believes that stocks are the only reliable way to outpace inflation and generate real wealth over time. While cash and bonds may offer short-term stability, their purchasing power erodes in the long run. A well-constructed equity portfolio, in contrast, provides access to the enduring growth of businesses and economies across the globe.

- Diversification Reduces Risk

Although equities are central to a strong portfolio, diversification across industries, geographies, and asset classes helps buffer against sudden market shocks. The goal? Avoid letting any single event or sector derail your long-term plan.

- Bonds Have a Role—But a Limited One

According to Murray, a traditional 60/40 “balanced” portfolio is not optimal for long-term investors. Bonds, he argues, primarily serve as a psychological cushion. For those with a lengthy time horizon, over-allocating to bonds can actually increase the risk of running out of money in retirement. The risk of a loss of purchasing power is often much greater than the risk of short-term market volatility.

- Investor Behavior Matters More Than Portfolio Construction

Even the best-designed portfolio can fail if an investor succumbs to panic. Murray emphasizes that market volatility is not the true enemy—emotional decisions are. Remaining invested through bear markets is the key to compounding wealth.

- No Market Timing—Ever

Attempting to forecast short-term market movements is a fool’s errand, says Murray. Rather than chasing trends or reacting to market noise, investors should rely on a disciplined, repeatable process that keeps them invested for the long haul.

- Retirees Need a High Allocation to Equities

One of Murray’s more controversial stances is that retirees should still hold significant equity exposure. Why? Because the greatest threat in retirement is inflation. If a retiree’s portfolio does not grow over time, their purchasing power diminishes—often severely—in the later stages of retirement.

How Gatewood Builds On Murray’s Principles

- Purpose-Driven Investing

Wealth is personal. Every portfolio we construct at Gatewood aligns with our clients’ values, goals, and long-term vision. Rather than defaulting to cookie-cutter strategies, we develop personalized allocations for business owners, high-net-worth families, and individuals navigating complex financial scenarios. Your portfolio aligns with your overall financial plan and your personal preferences.

- A Systematic, Process-Driven Approach

We take the behavioral aspect of investing seriously. While discipline is crucial, relying on willpower alone is risky. Instead, we employ a structured, repeatable process that helps clients avoid emotional pitfalls—particularly during turbulent markets.

- Enhancing Diversification With Alternative Strategies

Equities remain the core of our portfolios, but we also incorporate alternative investments and tax-optimized strategies to help mitigate risk and enhance long-term returns. This added layer of diversification complements Murray’s model while adapting it to today’s investment landscape.

- Planning for the Transition to Retirement

Rather than defaulting to a blanket recommendation for high equity exposure, we craft personalized withdrawal strategies that consider your income needs, tax exposure, and continued growth potential. A well-constructed equity portfolio provides access to the enduring growth of businesses and economies across the globe.

- Data-Driven Risk Management

Discipline matters, but data does too. We use real-time financial modeling and stress testing to keep our clients prepared for the unexpected. This helps keep both your portfolio—and your peace of mind—intact, even in worst-case scenarios.

The Bottom Line: Principles + Process = Success

Nick Murray’s philosophy offers a timeless foundation for building long-term wealth. However, execution matters as much as the theoretical framework. At Gatewood, we pair Murray’s principles with our own strategic process—one designed to guide you through market ups and downs with confidence.

Long-term investing is simple, but that doesn’t mean it’s easy. If you’re looking for a financial partner who blends the discipline of a seasoned advisor with the personalization that real families and businesses need, we’d love to help. Let’s develop a plan that aligns with your purpose, your goals, and your future.

Ready to Take the Next Step?

If you’re ready to explore how these principles can translate into real-life wealth strategies for you or your business, schedule a conversation with Gatewood today. We’re here to help you build, protect, and maximize your wealth—so you can focus on living the life you’ve envisioned.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value

Bonds are subject to credit, market, and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price

Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.